1. SavvyMoney Overview

What is SavvyMoney?

SavvyMoney is a comprehensive Credit Score program offered by Bridge Credit Union. It helps you stay on top of your credit. You get your latest credit score and report, an understanding of key factors that impact the score and can see the most up-to-date offers that can help reduce your interest costs. With this program, you always know where you stand with your credit and how your financial institution can help save you money. Credit Score also monitors your credit report daily and informs you by email if there are any big changes detected such as a new account being opened, a change in address or employment, a delinquency has been reported or an inquiry has been made. Monitoring helps users keep an eye out for identity theft.

What is SavvyMoney Credit Report?

SavvyMoney Credit Report provides you with all the information you would find on your credit file including a list of open loans, accounts, and credit inquiries. You will also be able to see details on your payment history, credit utilization, and public records that show up on your account. Like Credit Score, when you check your credit report, there will be no impact on your score.

Is there a fee?

No. SavvyMoney is entirely free and no credit card information is required to register.

2. Security and Accuracy

How does the SavvyMoney Credit Score differ from other credit scoring offerings?

Retrieves credit profiles from TransUnion and utilizes VantageScore 3.0 to ensure uniform scoring information. A credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers with a better picture of their credit health.

How does SavvyMoney Credit Score keep my financial information secure?

SavvyMoney uses bank-level encryption and security measures to keep your data safe and secure. Your personal information is never shared with or sold to a third party.

What if the information provided by SavvyMoney Credit Score appears to be wrong or inaccurate?

The SavvyMoney Credit Score makes its best effort to show you the most relevant information from your credit report. If you think that some of the information is wrong or inaccurate, we encourage you to take advantage of obtaining free credit reports from www.annualcreditreport.com and then pursuing with each bureau individually. Each bureau has its own process for correcting inaccurate information but every user can “File a Dispute” by clicking on the “Dispute” link within their SavvyMoney Credit Report. However, The Federal Trade Commission website offers step-by-step instructions on how to contact the bureaus and correct errors.

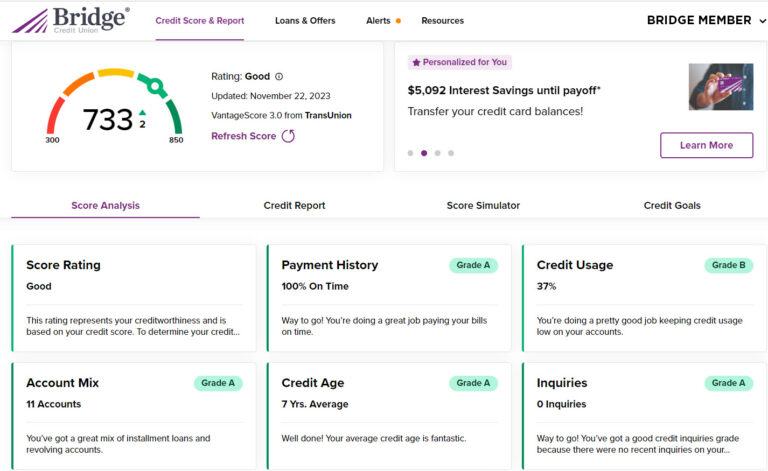

Image taken from SavvyMoney’s desktop dashboard – Your comprehensive tool for smart budgeting, credit management, and financial success.

3. Benefits and Purpose

Why do we offer it?

SavvyMoney Credit Score helps you manage your credit, ensuring a clear picture of your credit health. When securing loans for major expenditures such as a home, car, or college, it enables you to qualify for the most favorable interest rates available. You’ll also see offers on how you can save money on your new and existing loans with Bridge Credit Union.

Why do I come across both Bridge Credit Union product offers and financial education articles on the website?

Based on your SavvyMoney Credit Score information, you may receive Bridge Credit Union offers on products that may be of interest to you. In most cases, these offers may have lower interest rates than the products you already have. The educational articles, written the SavvyMoney team, are designed to provide helpful tips on how you can manage credit and debt wisely.

4. Credit Inquiries and Monitoring

Will accessing SavvyMoney Credit Score ‘ping’ my credit and potentially lower my credit score?

No. Checking SavvyMoney Credit Score is a “soft inquiry”, which does not affect your credit score. Lenders use ‘hard inquiries’ to make decisions about your creditworthiness when you apply for loans.

Does SavvyMoney offer credit report monitoring as well?

Yes. SavvyMoney will monitor and send email alerts when there’s been a change to your credit profile.

5. User Interaction

How do I change my email address or other personal information?

If you access the SavvyMoney program through your online banking, there’s no need for action on your part! Your email address will be automatically updated in SavvyMoney when you make the update in online banking. Nevertheless, we recommend keeping your financial institution informed of any changes to your contact information.

Can people use SavvyMoney on mobile devices?

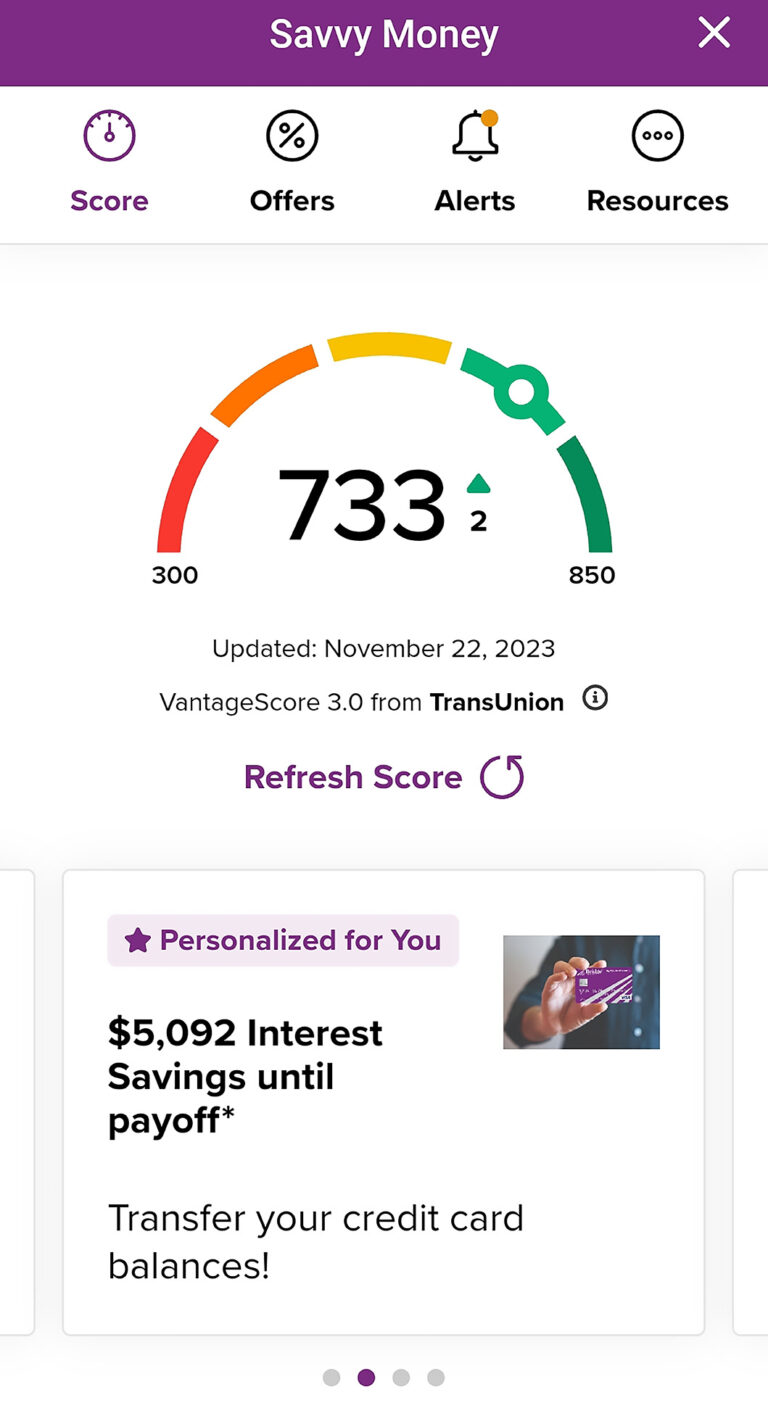

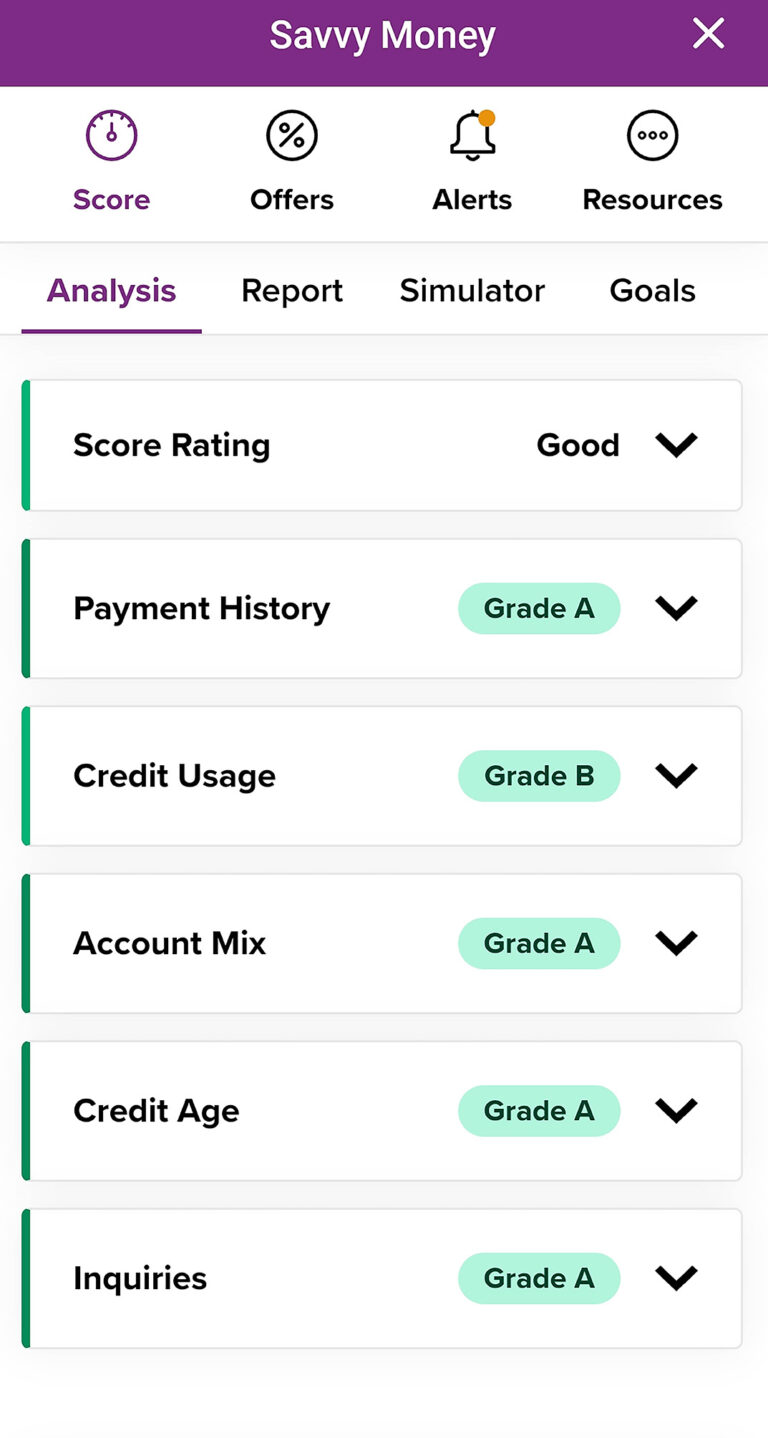

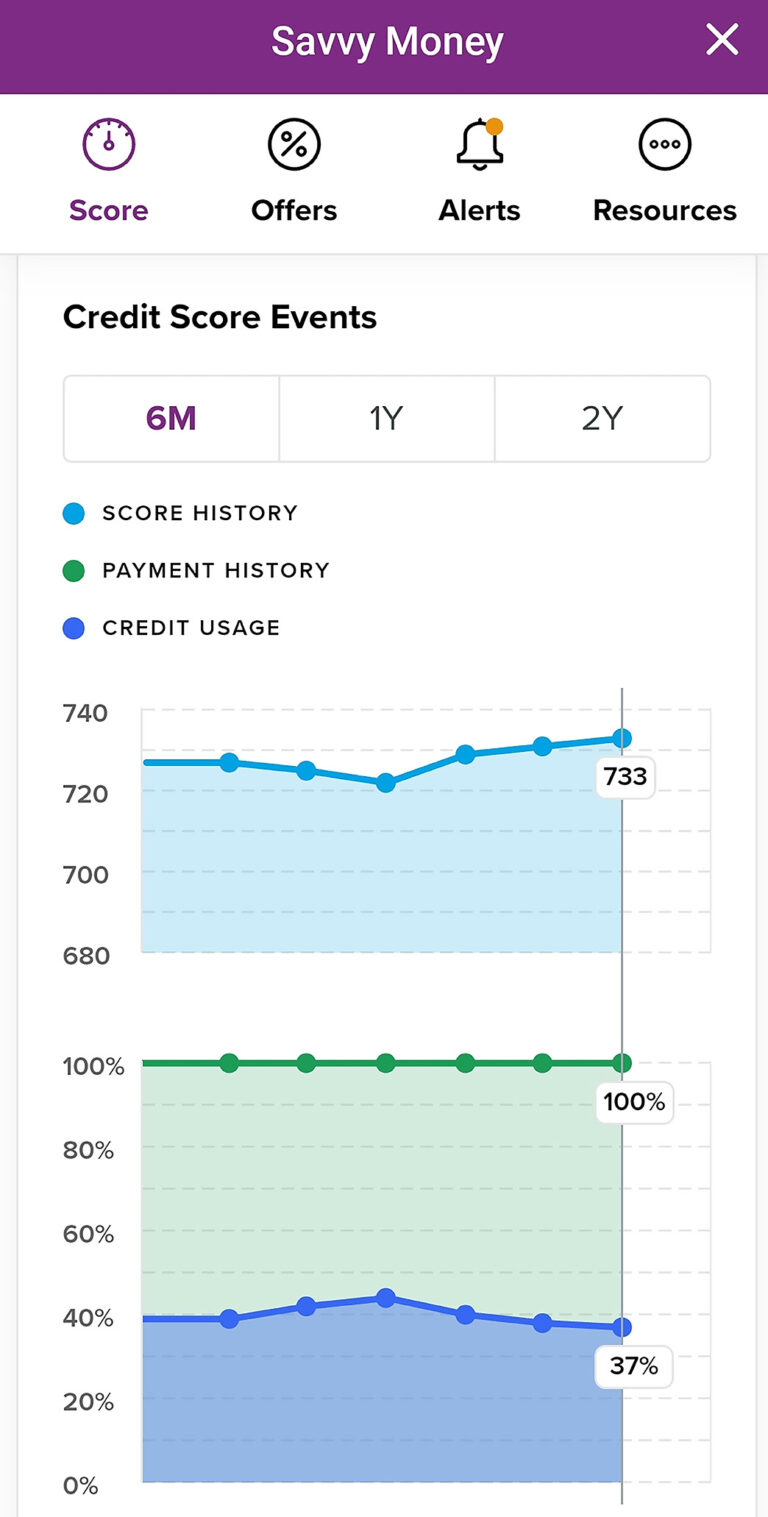

Yes, SavvyMoney Credit Score is available on mobile devices through its integration within Bridge’s mobile application. Once signed into the Bridge app go to “My Accounts” and select “Credit Score”.

Image taken from SavvyMoney on mobile – your pocket-sized guide to smart money management and financial success.