Saving money can be difficult at times, especially after the challenges that so many have faced during the COVID-19 pandemic. Despite challenges, it can be done with proper planning, due diligence, and commitment. No matter how big or small the goal is, there are 3 basic steps that you can take to help achieve your saving goal.

1. Analyze Your Finances

Part of planning is making the plan realistic. When it comes to financial goals, you need to be mindful of your regular income and expenses. You can put together a budgeting spreadsheet to itemize your sources of income and expenses which include things like rent, mortgage, grocery, utilities, etc.

2. Write It Down

Prioritize your goals based on what is most important to you. Come up with a list of what your savings goals are. While planning, make sure that you set funds aside for an emergency fund. It is important to have funds set aside and dedicated to unforeseen circumstances. Be sure to put the proper price tags on each goal by researching the total cost to avoid added expenses.

3. Set a Time Frame

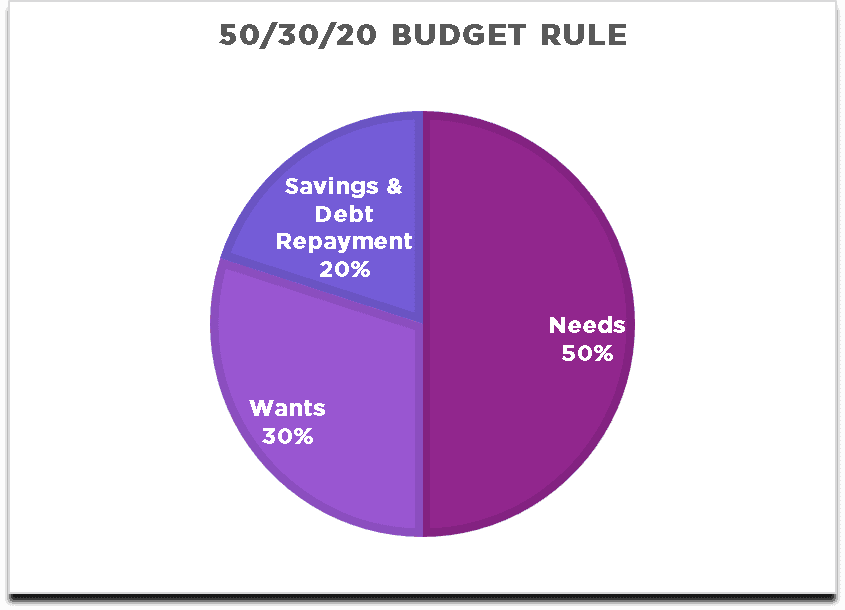

After you analyze your finances, figure out what your goals are, and write down your goals you can now determine how long it will take you to reach each goal. You can use the 50/30/20 rule to help calculate the length of time needed for each goal:

Using these 3 steps will help you come up with a solid plan for saving in 2021. Bridge offers a variety of savings account options to help you along the way to reaching your goals. Learn more here.

Using these 3 steps will help you come up with a solid plan for saving in 2021. Bridge offers a variety of savings account options to help you along the way to reaching your goals. Learn more here.

For financial wellness courses on budgeting, click here.

Source:

https://www.nerdwallet.com/article/finance/nerdwallet-budget-calculator